Recalculating ROI for a commercial building retrofit

October 18, 2024

October 18, 2024

Which decarbonization strategies for downtown buildings pay for themselves

When taking on a commercial building retrofit, property owners want a strong return on investment (ROI). Now they have good reasons to consider investing in their buildings to reduce their energy appetites and achieve net zero carbon.

There’s a new set of motivating factors and justifications to do so: energy savings, avoiding fines, attracting tenants, and staying competitive in the commercial real estate market.

The pathways to ROI for commercial building retrofits are expanding. Owners have more reasons to justify upgrading their buildings to reduce their energy use. These reasons can include market advantage, energy costs, and avoiding penalties. Let’s dig deeper.

1. Market advantage. Owners will invest in commercial building retrofits that benefit their business and result in more tenants signing leases. Retrofitting their spaces for net zero emissions earns owners bragging rights in the marketplace. And this can help them attract certain tenants. Owners can then justify charging more for leases to high-caliber tenants who desire low- or zero-emissions buildings.

Cities are starting to enforce new building-performance standards with fines. With that, there’s an increasing risk that buildings that don’t meet standards can become stranded assets. So, owners who make wise investments in decarbonizing their existing buildings today have an opportunity to stay competitive in the marketplace for years to come.

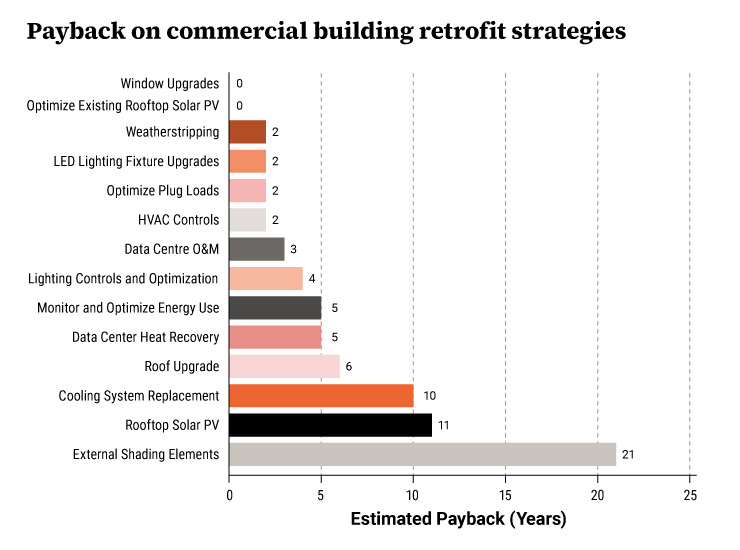

2. Energy costs. Owners who invest in decarbonization and commercial building retrofits will use less energy and pay less in monthly utility bills. Retrofits that slim down energy use will pay for themselves over time. Some retrofitting strategies offer payback sooner than others, as shown below.

Estimated payback time for retrofitting strategies on a recent commercial project.

3. Avoiding penalties. New York, New York, and other cities with building-performance standards are already enforcing their new rules. Building owners should consider retrofitting to meet new emissions targets because those who delay can face substantial fines. With more cities across the US passing similar legislation, owners need to be proactive in looking for ways to reduce or eliminate the chances they will be fined.

So, building owners know they need to invest in commercial building retrofits. But where? They should be looking for strategies that will pay for themselves in time. So, which approaches will deliver the best ROI and reduction in emissions?

Every facility is different. So, there are no cookie-cutter solutions. Yet we have seen some approaches that yield results and have broad applications.

For owners pursuing a commercial building retrofit, we conduct studies on their current situation to set up a benchmark. We gauge where they are in terms of their energy use. We can then model the potential reduction in energy use and carbon emissions for various design and system interventions. Next, we can apply these results to determine savings and estimate the payback time for a mix of interventions.

Sometimes the payback period for a retrofit project can be less than five years. Even if the ROI takes longer, the reductions in monthly energy costs and greenhouse gas emissions can be huge. Understanding payback time on retrofitting and updates can help owners justify their capital expenses.

UC Davis Health in Rancho Cordova, California, utilizes an air-source heat pump for radiant heating and a water-cooled centrifugal chiller. This approach leads to a space that is free of mechanical ducting, provides direct heating and cooling, and reduces recirculated air and the potential for the distribution of allergens.

We recently finished a green audit of a commercial portfolio. With it, we created a menu of possible commercial building retrofit strategies and their estimated payback time. While this estimate was specific to a portfolio, it’s still a useful way to illustrate where investments in existing buildings can pay for themselves in energy savings.

Window upgrades provide quick payback on investment. Older buildings are more likely to have windows that don’t meet requirements in the current energy code. Older window assembly and glazing lack the required thermal insulation. Upgrading to modern windows or window films in these buildings can reduce overall thermal loss and heat transmission.

LED fixture upgrades are a no-brainer. Upgrading your building lighting to LED is an easy decision. LED lighting uses far less power than fluorescent fixtures, 12–22 watts versus 28–56 watts for a typical 4-foot fixture. LEDs are an easy and affordable upgrade to employ that will pay for themselves.

Roof upgrades have longer payback times. In our example, the roof upgrade would require more than six years to pay for itself. Energy reduction through roof upgrades is typically lower in an urban environment because the roof area is typically smaller than the building façade area. A large building in a rural area has more thermal transmission through the roof. Payback is longer for roofs in an urban environment.

Even if the ROI takes longer, the reductions in monthly energy costs and greenhouse gas emissions can be huge.

Why upgrade a roof? Insulation. On buildings built before the early 2000s, the roof construction often consists of layered felt and asphalt with minimal insulation, resulting R-values of 3 to 15. Current roof construction, “a buildup roof,” features layers of continuous insulation over synthetic rubber, polyvinyl chloride, or thermoplastic polymer. They often achieve R values of 30 or 33 and above. Because of the cost of roof upgrades, they’re more attractive when an old roof is due for replacement.

Take the heat your servers are putting out and use it. Data centers generate heat. We can repurpose the large amounts of heat generated by server rooms to provide heat and domestic hot water for the office space. In New York City, some data centers are injecting their excess heat into a new underground thermal energy network.

In cities like New York, the cost to replace the façade for a 30- or 40-story building can run to tens of millions of dollars. We need to consider the safety and protection of occupants and neighbors in this kind of commercial building retrofit. This makes it less likely for us to see façade replacement implemented on a high-rise. But it might be viable for a mid- to low-rise building.

New York City is pushing for solar adoption. And solar is becoming more practical as a renewable energy source because of advances in on-site energy storage.

However, decarbonizing buildings in dense urban areas is challenging. Once electrified, they need power from somewhere. And it’s unlikely that a building over three stories can get enough on-site electricity from a rooftop solar array to meet all its needs. Thus, downtown buildings will need to look at offsite renewable energy sources such as solar and wind power.

District Carbon demonstrated that retrofitting a façade and rebalancing program could make an impact on carbon. (Image courtesy of ZGF Architects)

To calculate ROI, we usually compare the building’s existing performance with its performance after we have retrofitted it to use less energy. In some situations, however, it makes sense to compare a retrofitted building with one that will be demolished and replaced with new construction. We developed District Carbon, a competition-winning project, with ZGF Architects, KPFF, Lease Crutcher Lewis, and various consultants. On District Carbon, we showed it was possible to retrofit a commercial building in downtown Seattle, Washington, to achieve net zero carbon.

Through our District Carbon entry, we found a key innovation for retrofitting projects where repositioning is possible. We rebalanced the program to optimize the building’s energy use while allowing for some continued occupancy during phased construction. Our data model showed us that a mix of 80 percent residential and 20 percent office would reduce the building’s energy use intensity. The changes dropped it from 53 to 19 when compared to a 100 percent office space building.

As we’ve shown, implementing even minor improvements to existing buildings in commercial building retrofits can result in energy savings for owners. Additionally, these upgrades can help owners avoid fines and attract tenants willing to pay more to lease an efficient space. From updating lighting fixtures and windows to complete façade and roof replacements, owners can make wise investments. Those choices will help decarbonize their existing properties and make them money.